Going public? Why a virtual roadshow is more efficient for companies and investment banks

An IPO during a global pandemic

In May 2020, just two months into the first Covid-19 lockdown in Europe, Pexip completed its IPO and was listed on the Oslo Stock Exchange. As our listing happened, a crisis was rapidly unfolding across the globe. Offices were closed, markets were in flux, and people sheltered in place at home, wondering how long this pandemic would last and what the long-term effects might be, both to human health and the global economy.

Going public at a moment like this seems at best risky, and at worst, impossible. From the perspective of both the company and the investors, the idea of taking a financial leap right when global markets were potentially on the verge of collapse was, some might say, a bold move. While it's true that our product - a video conferencing platform for large enterprises - could be seen as a highly relevant product to invest in at the time, the atmosphere of economic uncertainty meant that any large investment was a potential risk for all parties.

And crucially, financial and strategic considerations aside, what about the actual logistics of completing an IPO 100% remotely? When an overnight catastrophe dictates that you can’t travel, or shake hands, or even be in the same room for internal or external business-critical meetings, how do you even complete the process? The pandemic caused many companies to defer launching IPOs in spring 2020. At Pexip, we decided to try something new.

What did our virtual IPO actually look like, and what are the takeaways?

Preparing for your company’s Initial Public Offering (IPO) involves many different people and organizations. In autumn 2019, we decided to do a public listing. Going public was seen as a strategic path to boosting brand awareness, accelerating investments, and making our shares more liquid, which could diversify our ownership. We chose ABG Sundal Collier, Carnegie, and Pareto Securities as the investment banks that would do the joint global coordination of the IPO, both for their local and international reach, and because we knew they were the right people for our team as we took on this challenge.

What would have normally happened next is that, over the period of several months, analysts, investment bankers, and company executives, myself included, would fly around the world for in-person meetings and presentations. This makes for a hectic schedule that involves airports, hotel rooms, and jet lag, along with the stress of travel. For most companies, a huge amount of time, money, and resources goes into this period, making the process of securing investments an investment in itself.

In January and February 2020, right before the pandemic hit, we were able to conduct our first early-look meetings in person. But by the time March arrived, bringing with it travel restrictions and social lockdowns everywhere, we were forced to switch to 100% virtual meetings.

Initially, there was some pushback from investors and investment bankers when we decided to go ahead with the process using only video meetings - after all, this was unprecedented in so many ways. But the other parties quickly adapted. Using our own video conferencing platform, we proved to the financial industry that a virtual IPO is not only possible, it may even be preferred. In our IPO press release, Peter Straume, Managing Partner and Chief Executive of ABG Sundal Collier Norway stated:

“We have shown that conducting a virtual IPO process is possible, and believe it makes sense for the finance industry and for IPOs in general. This is the first time we have held a virtual roadshow, but we would recommend it for the future, even without lockdown.”

Øivind Amundsen, CEO of Oslo Børs (The Norwegian Stock Exchange), rang the bell with all of Pexip as we officially went public.

Why are virtual and hybrid IPOs the “next normal”?

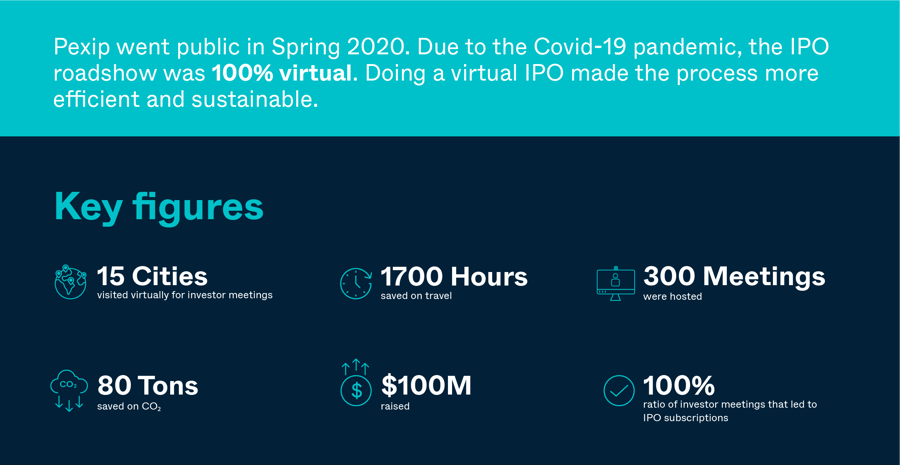

- Efficiency. For us at Pexip, meetings were conducted with investors in over 15 cities, and working on video rather than being dependent on travel itineraries meant that meetings could be more flexible and open to last minute changes during a packed agenda. For Pexip, 100% of the virtual one-to-one meetings on the roadshow led to subscriptions to the IPO, demonstrating how virtual meetings can be just as impactful and effective as in-person, even for complex negotiations.

- Money saved. For every remote meeting you conduct over video, you can subtract the cost of airfare, hotels, and other travel expenses. When meeting with multiple international investors, this amounts to a huge amount of savings. In addition, since video meetings save so much time, you’re also saving on billable hours from law firms, analysts, and other advisors. While you’ll want to invest in reliable video conferencing infrastructure before starting the process (more on that below), the savings from reducing or eliminating travel will vastly outweigh the cost of your meeting technology.

- Time saved. Estimations show that we saved over 1700 hours (more than 70 days) of travel time. Investor meetings happened quickly, and the whole process was sped up. This meant that we were able to run the IPO process while still having time to stay on top of running the business. In addition to one-to-one meetings with investors, we also did group presentations, and were able to gather up to 200 investors in one video meeting to hear our story.

- A lighter environmental impact. Our calculations show that by not traveling, we saved over 80 tons of CO2, or roughly the amount that 10 Norwegians use over an entire year. We are in a climate crisis, and companies who are ready to go public must also be thinking about their environmental impact and how their operations can be made more sustainable. What better way to get started as a publicly-listed company than by reducing your carbon footprint on the way to the stock exchange?

Throughout our process, Pexip raised over $100 million, and the offering was oversubscribed early. Yes, video conferencing was top-of-mind due to current events, but it was also a difficult time to make large investments. Ultimately, it was our unique technology and our story, told over video meetings - a great opportunity for product demos - that convinced investors to come aboard. Pexip was able to attract investments from all across Europe and the United States without ever leaving home.

What to consider when approaching a virtual IPO

If you’re the company:

Pursuing a listing is a decision that will have been carefully considered as both a long-term growth strategy and a way to fuel money into your product portfolio. Accelerating your company journey by doing a public listing will require meetings (a lot of them), from initial discussions right up to the day of the listing.

As demonstrated by Pexip, shifting some, if not all, of these from physical to video meetings can make the process significantly more efficient, and save time and money that can be redirected toward growth efforts.

We at Pexip were in a unique position; video is our product, but it’s also our company culture. Internally, we were well-prepared for the challenges of a) presenting and negotiating in such high-stakes video meetings, and b) convincing investors that this method of communication was an effective and secure alternative to in-person interactions.

A year later, the rest of the business world has caught up, and video is now central to the way millions of people work. Covid-19 was a catalyst for organizations everywhere to adopt rapid digitalization, and while video conferencing was once a “nice to have” communications tool, it is now a business-critical component of every major organization’s IT. And it’s here to stay. The past year has proven that more can be done virtually than we ever realized - including the process of taking your company public.

If you’re the investment bank:

In February 2021, I participated in a panel discussion at the SHE Conference, titled “Finance for all: A walk through the Pexip IPO Story.” I was joined by key participants from ABG, the investment bank who acted as our global coordinator, and they provided compelling insight into what the virtual IPO looked like from their perspective.

One of the panelists was Kjersti Syversen, Head of Corporate Access for Norway ABG S.C. Kjersti is responsible for giving investors access to company management teams and acting as the link between the investors and the company. Her team coordinates meetings and presentations throughout the IPO process and ensures that information is given to both parties so that everything runs smoothly on the roadshow.

“Normally the company would travel across continents to meet investors where they are located, which requires a lot of planning and logistics,” she explained on the panel. “During this process, to balance the interests of company management, brokers, and investors, you have to remain service-minded and open-minded.”

Kjersti Syversen, Head of Corporate Access for Norway ABG S.C., speaking about the Pexip virtual IPO.

In the case of Pexip’s IPO, being open-minded meant adapting to the challenges of Covid-19 and shifting to a virtual roadshow. Which, she said, actually improved the process.

“By using video meetings, company management can meet more investors across the globe in a much shorter period of time; you can have meetings with investors in Toronto and Asia all in the same day. For the Pexip IPO we hosted around 300 meetings, both one-to-one and group presentations, and were able to gather 140-200 investors per presentation.”

Also joining me on the panel was Hans Øyvind Haukeli, Co-Head of Sales & Fixed income ABG S.C. who said this this about our IPO:

“The special thing about Pexip was that it was launched at a time with a lot of uncertainty in the market. We started marketing the deal in February and got a lot of interest, and then the market collapsed in March 2020. We thought, what do we do now? With the risk-adverse market, we knew we had to do something new.”

“Ultimately,” he continued, “it was far more efficient to have a 100% virtual roadshow. It gave us access to an unlimited number of participants in meetings, and I don’t think we’ve had that many quality investors looking at a deal, ever. Doing this virtually, or as some kind of hybrid with far less traveling will probably remain the industry standard after the pandemic.”

How to optimize your virtual meetings to meet the demands of the IPO process

Pexip’s situation at the height of the first lockdown created a uniquely challenging scenario that required a fully virtual roadshow. Post-pandemic, when offices are reopened and travel has resumed, it's likely that IPOs for most companies will be a hybrid approach, with both virtual and in-person meetings. Here are a few best-practice tips from someone who has done it.

Before setting up video meetings for IPO-related discussions and negotiations, whichever side of the table you’re on, it’s important to have reliable video infrastructure in place, and to be prepared for the culture of virtual meetings.

- Make sure your organization is using a video meeting platform that’s interoperable. Having a platform that serves as a gateway between different hardware and video services will make it easier for your team to quickly join meetings from anywhere, regardless of what video service the other meeting attendees are using. When the stakes are high, being able to join the meeting quickly and easily will calm nerves and ensure you’re always on time.

- Invest in a high-quality microphone and camera, and set up your meeting spaces, both at home and in the office, with good lighting and camera positioning. Meeting face-to-face means you need to make a great first impression, even over video.

- Brief your team on video meeting etiquette, and make sure everyone understands how to navigate your platform’s call controls, such as mute, turning the camera on/off, and best practices for screen sharing and virtual presentations.

- Involve the whole organization. One of the most rewarding moments of Pexip’s IPO was ringing the bell - hundreds of bells, actually - in unison with all of our employees. While this is usually a ceremony only enjoyed by C-level executives and board members, we were able to involve everyone who helped us achieve this major milestone.

The past year has been one of immense change for Pexip, and completing the IPO was an important driver for our growth. Our mission is to bring people together, regardless of their location or technology, and we're achieving that every day.

We’re proud to have been able to prove that you don’t need to travel the globe to attract investors and secure capital. In fact, it may be better if you don’t. Ours turned out to be what was at the time, the biggest software IPO ever done in Scandinavia. At Pexip we have a culture for taking on challenges, and now that we’ve overcome this one, I think we’re ready for anything.

Hear more about our IPO story in the Euronext webinar “European Tech Sector: Going public in the current environment” from April 2021.

Learn more about Pexip’s video solutions for the financial sector, or contact us today.